"Strong and sustained recovery" - Headlam

March 9, 2021

Headlam, the UK's largest flooring distributor, recovered from a 30% crash in flooring sales in the first half of 2020 to turn a loss of £1.2m in those 6 months into a final profit of £15.9m for the year overall, following "exceptional performance from the UK residential sector."

Following that 30% sales hit in the first half of 2020, Headlam ended the year with annual trading levels 15% below those of 2019.

While 2020's full-year profits of £15.9m before tax are substantially below the 2019 profits of £39.5m, it suggests Headlam was trading at more "normal" levels for the second half of 2020, which is a positive achievement given the subsequent lockdowns and continuing uncertainty.

"Following the significant impact of COVID-19 on trading in Q2 2020, when the vast majority of the Company's operations were temporarily closed, the second-half was characterised by a strong and sustained recovery," said non-executive chairman Philip Lawrence as the group announced its final results for the year ended December 31, 2020.

"This demonstrated the resilience of our business, the commitment and tenacity of our people, and our ability to support customers during a difficult period,' he said.

The Group said its commercial sector was materially down for the whole year, albeit with an improvement in the second-half.

A positive arising from a hugely difficult year, is that the Board believes the Company has entered 2021 a stronger business. It said ongoing mitigating actions against the impact of COVID-19, including a more centralised approach to the management of costs; accelerated projects under Headlam's Operational Improvement Programme (OIP) and "improved levels of stakeholder engagement" will support the future success of the Company.

The OIP efficiency project Headlam has embarked on is being accelerated and is expected to generate savings of £4m in 2021 and £8m in 2022.

The results showed Headlam remained highly cash generative during the year despite the initial impact of COVID-19, with an increase in cash of £27.0 million (2019: £10.2 million decrease) and in part reflects the actions taken to preserve Balance Sheet strength. Average net debt for the year of £8.6 million (2019: £3.3 million) was also a material reduction on the first-half average net debt of £35.3 million.

SEARCH OUR NEWS SERVICE

FEATURED ARTICLES

In the constantly changing world of wholesale and retail flooring, staying ahead requires embracing digital tools that streamline operations, reduce costs and improve customer service. By developing industry-specific software that address the unique challenges faced by flooring businesses, klipboard is enabling the flooring supplies industry to improve their operations through technology.

The Cavalier in-store sales kit is well-known throughout the trade for its striking appearance, clean, crisp lines in a stunning white powder coat finish, which as well as making samples stand out against it, disguises its robust steel construction. Designed by Cavalier, the products are all custom-built within walking distance from its Blackburn premises.

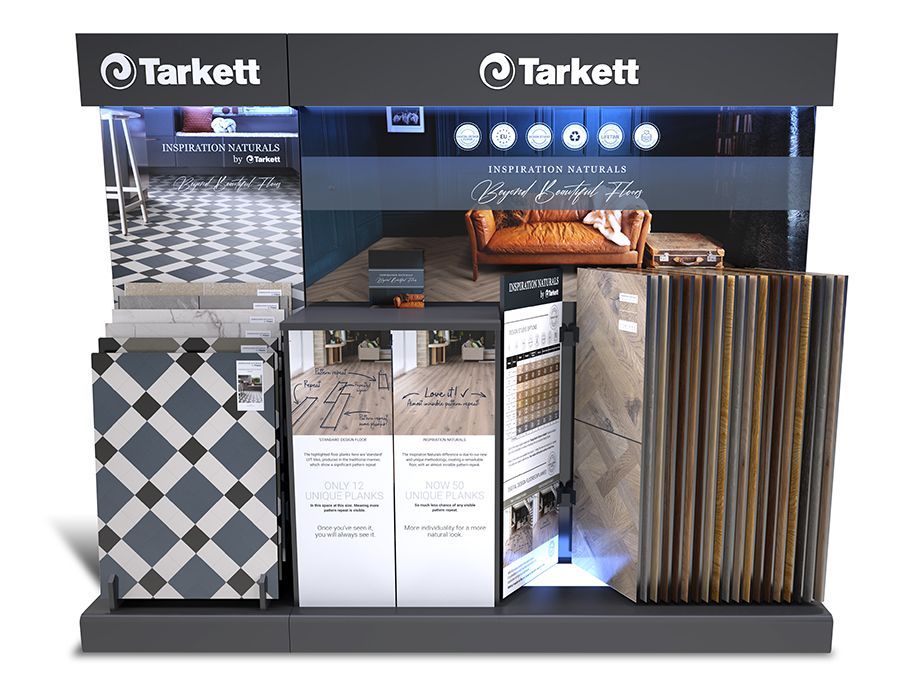

When it comes to supporting retailers in showcasing high-quality flooring products, Furlong Flooring leads the way with innovative and eye-catching Point of Sale (POS) materials. With decades of experience in the flooring industry, Furlong understands that first impressions count. That’s why its POS solutions are designed to make their extensive range of products not only easy to navigate but also impossible to ignore.

BUSINESS NEWS

The British Furniture Confederation (BFC), the public affairs umbrella body of furniture and beds, furnishings and flooring sector trade associations, has unveiled its new Plan for Growth. The document is said to support BFC’s advocacy across four key pillars: skills and education; trade and exports; standards and regulations; and the environment and circular economy. It has been developed over the past few months, the organisation says, evolving from a combination of position papers written by the associations’ executives and a comprehensive survey of their collective members.

Consumer card spending grew 1.0% year-on-year in February – lower than January’s 1.9% increase and less than the latest CPIH inflation rate of 3.9%, according to recent figures reported by Barclays. In anticipation of higher bills, consumers are said to be cutting back on essential outgoings, but still prioritising discretionary purchases, contributing to an uptick in optimism in the health of personal and household finances.

Kellars, which describes itself as the largest independent flooring wholesaler in the UK, saw another year of “substantial growth” to July 2024, according to its strategic report for the period. With six depots across the UK and a team of more than 100, the company has reportedly grown at a “rapid rate,” with the year leading up to July 2024 seeing a dramatic rise.

Victoria PLC, an international designer, manufacturer and distributor of flooring, today announces the planned appointment of Alec Pratt to the Group board as Chief Financial Officer Designate, who will replace Brian Morgan after three years’ service as Victoria’s Chief Financial Officer in June.

Based on data from the Office of National Statistics (ONS), carpets and other floorcoverings saw inflation of 0.6% in January, though this is set against a 2.5% fall last month. In January of last year the same category saw a 0.5% decline.

GfK’s long-running Consumer Confidence Index increased by two points to -20 in February. All measures were up in comparison to last month’s announcement.

Mohawk Industries has announced fourth quarter 2024 net earnings of $93m (£71.8m), with adjusted net earnings at $123m (£95m). Net sales for the fourth quarter of 2024 were $2.6bn (£2bn), an increase of 1.0% as reported and a decrease of 1.0% on an adjusted basis versus the prior year.

Likewise Group, a UK flooring distributor, has announced the completion of its purchase of a freehold Logistics Centre in Ivybridge near Plymouth.

VAT and PAYE records from HM Revenue and Customs, compiled by The Furnishing Report, have revealed the number of flooring retailers with sales over £1m reached a record high in 2024.

GfK’s long-running Consumer Confidence Index decreased by five points to -22 in January. According to the organisation, all measures were down in comparison to last month’s announcement.

READ IT ALL ONLINE

Show More

Show More

With 57 designs to choose from and wonderful comfort with every footstep, customers will be feeling delight with the latest cushion vinyl collection from Beauflor. Ideal for homes and private areas within social housing, Feelings brings an affordable and stylish floor that has all the benefits of warmth, comfort and practicality.