Footfall recovers cautiously

May 7, 2021

Latest data confirms consumers are returning to UK high streets after lockdown but fall well short of pre-pandemic levels so far.

According to the latest BRC-Sensormatic IQ footfall monitor, which compares 2020 to 2019 to strip out the effect of the pandemic, total UK footfall decreased 40.0% in April. That was, however, a 28.7 percentage point improvement on March 2021, and was above the three-month average decline of 59.2%.

Helen Dickinson, chief executive of the British Retail Consortium, said: "With the easing of restrictions on retail and some hospitality, consumers have been returning to their local high streets, shopping centres and retail parks."

But she added: "It is unlikely we will see a return to pre-pandemic levels of footfall anytime soon, as social distancing measures naturally restrict retailers’ capacity.

"Growing consumer demand and footfall in the months ahead will be vital for the survival of many retailers, as they start to see costs increasing as stores reopen and colleagues return from furlough. With full business rates relief ending in England in June, the ongoing rates review needs to deliver on its objectives."

Andy Sumpter, Sensormatic Solutions’ retail consultant EMEA, said: "April’s reopening of retail saw a welcome boost for the high street. While footfall still remains 40% down compared to pre-pandemic levels, consumer demand signals for a return to in-store shopping were promising: shoppers happily braved long queues to get back in store and shop their favourite brands in real life.

"Retailers will be hoping that the lift in shopper traffic seen during the first few weeks of unlocking can be sustained past pent-up demand to fuel long-term recovery."

According to the latest BRC-Sensormatic IQ footfall monitor, which compares 2020 to 2019 to strip out the effect of the pandemic, total UK footfall decreased 40.0% in April. That was, however, a 28.7 percentage point improvement on March 2021, and was above the three-month average decline of 59.2%.

Footfall on high streets was down 43.9% in April, also up on the three-month average decline, of 61.2%. Retail parks reported a 30.5% fall in footfall while shopping centres were off 35.4%.

With the imminent opening of indoor hospitality, it is anticipated that the gap between the level of footfall in 2019 and 2021 will narrow further,

But she added: "It is unlikely we will see a return to pre-pandemic levels of footfall anytime soon, as social distancing measures naturally restrict retailers’ capacity.

"Growing consumer demand and footfall in the months ahead will be vital for the survival of many retailers, as they start to see costs increasing as stores reopen and colleagues return from furlough. With full business rates relief ending in England in June, the ongoing rates review needs to deliver on its objectives."

Andy Sumpter, Sensormatic Solutions’ retail consultant EMEA, said: "April’s reopening of retail saw a welcome boost for the high street. While footfall still remains 40% down compared to pre-pandemic levels, consumer demand signals for a return to in-store shopping were promising: shoppers happily braved long queues to get back in store and shop their favourite brands in real life.

"Retailers will be hoping that the lift in shopper traffic seen during the first few weeks of unlocking can be sustained past pent-up demand to fuel long-term recovery."

SEARCH OUR NEWS SERVICE

FEATURED ARTICLES

In the constantly changing world of wholesale and retail flooring, staying ahead requires embracing digital tools that streamline operations, reduce costs and improve customer service. By developing industry-specific software that address the unique challenges faced by flooring businesses, klipboard is enabling the flooring supplies industry to improve their operations through technology.

The Cavalier in-store sales kit is well-known throughout the trade for its striking appearance, clean, crisp lines in a stunning white powder coat finish, which as well as making samples stand out against it, disguises its robust steel construction. Designed by Cavalier, the products are all custom-built within walking distance from its Blackburn premises.

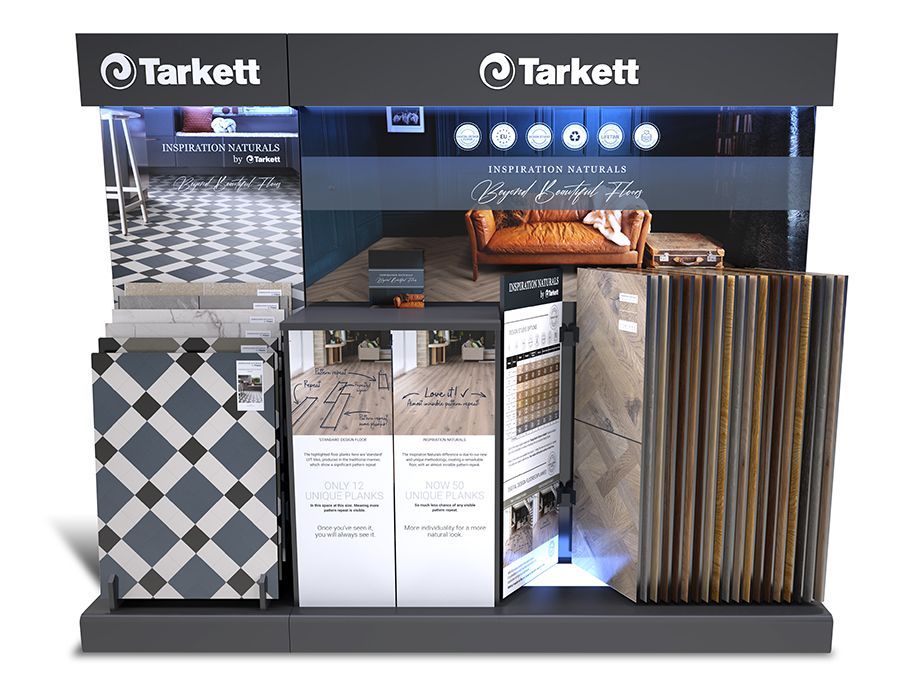

When it comes to supporting retailers in showcasing high-quality flooring products, Furlong Flooring leads the way with innovative and eye-catching Point of Sale (POS) materials. With decades of experience in the flooring industry, Furlong understands that first impressions count. That’s why its POS solutions are designed to make their extensive range of products not only easy to navigate but also impossible to ignore.

BUSINESS NEWS

The British Furniture Confederation (BFC), the public affairs umbrella body of furniture and beds, furnishings and flooring sector trade associations, has unveiled its new Plan for Growth. The document is said to support BFC’s advocacy across four key pillars: skills and education; trade and exports; standards and regulations; and the environment and circular economy. It has been developed over the past few months, the organisation says, evolving from a combination of position papers written by the associations’ executives and a comprehensive survey of their collective members.

Consumer card spending grew 1.0% year-on-year in February – lower than January’s 1.9% increase and less than the latest CPIH inflation rate of 3.9%, according to recent figures reported by Barclays. In anticipation of higher bills, consumers are said to be cutting back on essential outgoings, but still prioritising discretionary purchases, contributing to an uptick in optimism in the health of personal and household finances.

Kellars, which describes itself as the largest independent flooring wholesaler in the UK, saw another year of “substantial growth” to July 2024, according to its strategic report for the period. With six depots across the UK and a team of more than 100, the company has reportedly grown at a “rapid rate,” with the year leading up to July 2024 seeing a dramatic rise.

Victoria PLC, an international designer, manufacturer and distributor of flooring, today announces the planned appointment of Alec Pratt to the Group board as Chief Financial Officer Designate, who will replace Brian Morgan after three years’ service as Victoria’s Chief Financial Officer in June.

Based on data from the Office of National Statistics (ONS), carpets and other floorcoverings saw inflation of 0.6% in January, though this is set against a 2.5% fall last month. In January of last year the same category saw a 0.5% decline.

GfK’s long-running Consumer Confidence Index increased by two points to -20 in February. All measures were up in comparison to last month’s announcement.

Mohawk Industries has announced fourth quarter 2024 net earnings of $93m (£71.8m), with adjusted net earnings at $123m (£95m). Net sales for the fourth quarter of 2024 were $2.6bn (£2bn), an increase of 1.0% as reported and a decrease of 1.0% on an adjusted basis versus the prior year.

Likewise Group, a UK flooring distributor, has announced the completion of its purchase of a freehold Logistics Centre in Ivybridge near Plymouth.

VAT and PAYE records from HM Revenue and Customs, compiled by The Furnishing Report, have revealed the number of flooring retailers with sales over £1m reached a record high in 2024.

GfK’s long-running Consumer Confidence Index decreased by five points to -22 in January. According to the organisation, all measures were down in comparison to last month’s announcement.

READ IT ALL ONLINE

Show More

Show More

With 57 designs to choose from and wonderful comfort with every footstep, customers will be feeling delight with the latest cushion vinyl collection from Beauflor. Ideal for homes and private areas within social housing, Feelings brings an affordable and stylish floor that has all the benefits of warmth, comfort and practicality.