Flooring's natural immunity to retail decline

- So, although the Internet is seen as the adversary by many independent stores, in fact our sector is one of the most resilient to its subversion of bricks-and-mortar retail.

It is still difficult to differentiate between the many “me-too” flooring products without actually seeing and touching them – especially in the carpet sector but also in smooths. The “touchly/feely” argument was once used to suggest clothing would never be a massive sell online – that argument proved to be completely bogus but only for one reason, the flexibility of the returns policy adopted by online clothing retailers as a necessity to motivate a sale. Flooring is essentially a custom product, almost without the possibility of a returns policy.

- Our sector is relatively isolated from this effect too. Flooring is a “mission purchase” – i.e. consumers go out specifically to seek out a new floor, so traffic is not dependent on passing trade and impulse buying.

The internet is a net gain

None of this is to claim that the Internet is not a challenge to independent retailers but in reality it would appear to be a net gain. The web has made many retailers more findable and during the pandemic the use of video appointments and online booking for in-store appointments has proved especially successful for many.

The constant threat of online price comparison is mitigated to some extent by the difficulty of arranging installations and retailers have found own-label marketing, especially through the buying groups excellent programs to be a robust defence.

Credit is due to the majority of mainstream manufacturers who have been assiduous in providing highly efficient “find-a-retailer” functions on their websites for consumers who have found a branded range they want to buy.

However, the independent sector still lags in sophistication in many cases in regard to its online presence. Many consumers will make a decision which shops to visit only after Internet research of all the possibilities in their area so a smart online presence is essential and many websites need to be more updated than they typically are.

So what’s to worry about?

Well, the net is still a threat if your own online presence is poor. The chain stores are getting increasingly advanced and independents need to look sharp and ensure their websites show more offers, choices and contact/appointment options.

- Perhaps the greater threat to bricks-and-mortar retail than the big online stores, are the self-sellers/installers and trade counters.

The “man-and-van’ has moved up a gear in the last year or so – improving their internet appearance and served by an increasing savvy wholesale sector (and by some manufacturers directly)

Conclusion

The high street retailers’ answer to this threat is what it’s always been – accessible expertise, welcoming attractive store environments and service, service, service. Just make sure you keep in touch with your loyal customers more than anyone else does!

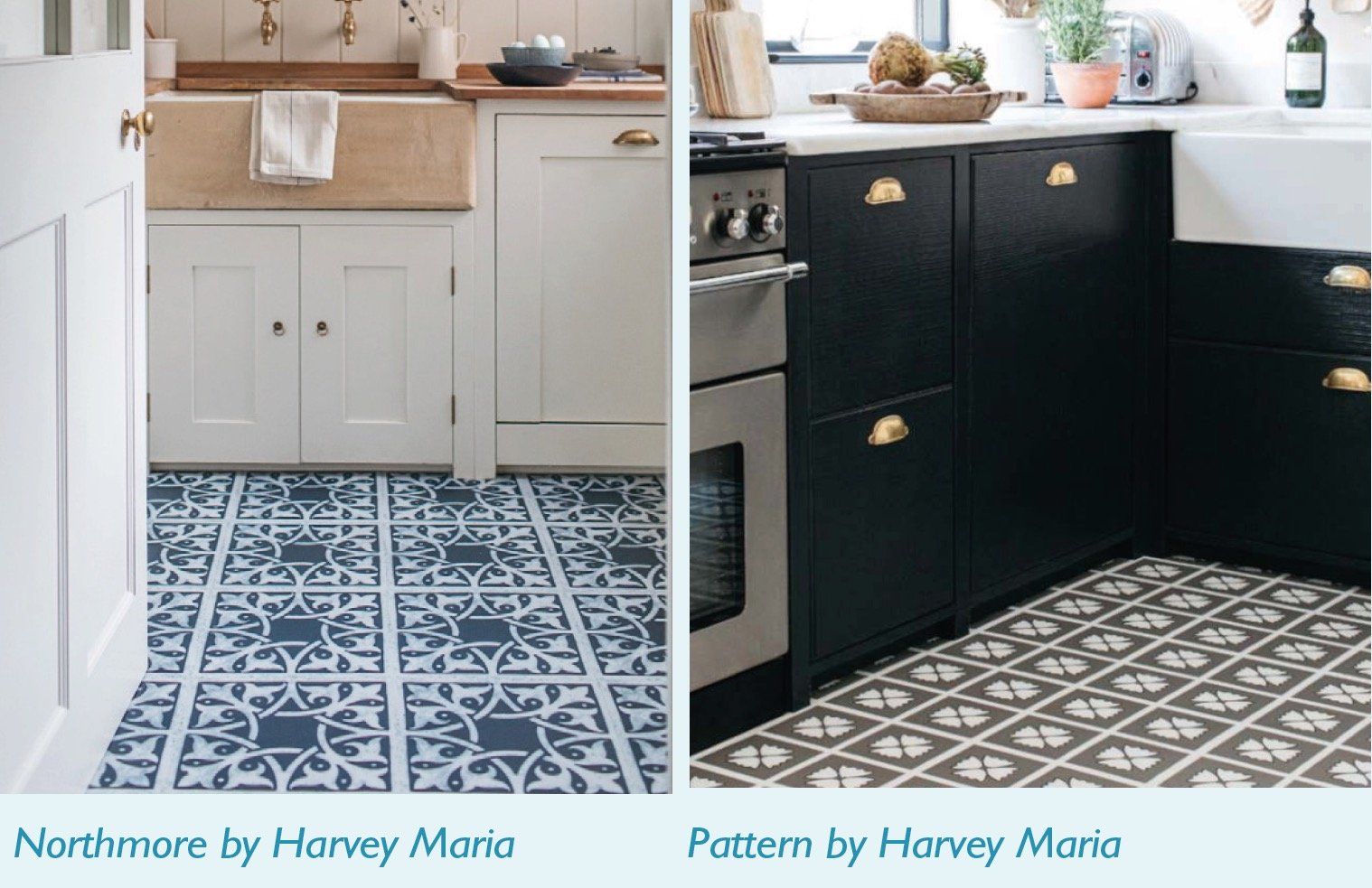

Hats off to Harvey Maria

For those retailers who worry that they are losing out to manufacturers who sell direct, hats off to Harvey Maria who have come up with a “have your cake and eat it” approach to help.

The smart LVT specialist operates a unique Local Online Sales Commission which means newly signed Harvey Maria retailers can enjoy a share of online sales in their locality, that is, products that they have not actually sold themselves.

“We pay our retailers a percentage of the invoice value on consumer orders received at harveymaria.com for delivery within the retailer’s territory,” says Mark Findlay of Harvey Maria.

“This is not only on their displayed collections, but we will also offer a percentage on all other collections to the Harvey Maria approved retailer closest to the order shipping address,” said Mark. “We think that this is a really unique way of supporting local business and traditional retail, which is extremely important within our industry.”